Sign up Deriv

Home » Sign up

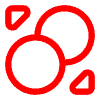

Registration Process Overview

Deriv provides straightforward account creation through digital registration procedures. The process requires basic personal information for account setup. Registration completion enables immediate demo account access. Account verification unlocks full platform functionality. Multiple account types accommodate different trading preferences.

Registration Requirements:

| Information Type | Requirement Level | Processing Time |

| Email Address | Mandatory | Immediate |

| Personal Details | Required | 1-2 minutes |

| Identity Verification | Required | 1-3 days |

| Proof of Address | Required | 1-3 days |

| Payment Information | Optional | Varies |

Initial Account Creation

Account creation begins with email address submission. Password creation follows security requirement guidelines. Personal information collection meets regulatory standards. Country selection determines available services. Registration confirmation arrives through email verification.

Personal Information Requirements

Registration requires specific personal identification details:

- Full legal name

- Date of birth

- Residential address

- Contact information

- Tax identification

- Employment status

Information Verification

Document submission confirms personal information accuracy. Verification processes follow regulatory requirements. Support assistance guides documentation submission. Processing times maintain standard completion windows. Additional information requests receive clear explanations.

Account Type Selection

Account options accommodate different trading preferences. Financial accounts enable CFD trading access. Derived accounts provide synthetic market access. Multiple currency options support trading preferences. Account features vary by regulatory jurisdiction.

Account Features

Trading capabilities depend on account type selection. Leverage ratios vary between account categories. Asset access differs across account types. Platform availability follows account specifications. Trading tools match account categories.

Demo Account Access

| Account Type | Min Deposit | Features |

| Financial | $5 | Forex, Stocks, Commodities |

| Derived | $5 | Synthetic Indices |

| Demo | $0 | All Markets |

| Swap-Free | $5 | Islamic Account |

Document Verification Process

Identity verification requires government-issued documentation. Address verification needs recent utility bills. Document submission occurs through secure channels. Processing maintains confidentiality standards. Verification status updates arrive through email.

Document Requirements

Passport copies meet identification requirements. National identity cards provide verification alternatives. Utility bills confirm residential address. Bank statements support address verification. Document validity follows specific timeframes.

Payment Method Registration

Payment registration enables account funding capabilities. Multiple payment methods support account transactions. Verification requirements vary between payment options. Processing times depend on method selection. Security measures protect payment information.

Available Payment Methods:

- Bank wire transfers

- Credit/debit cards

- E-wallets (Skrill, Neteller)

- Cryptocurrency transfers

- Local payment systems

- Payment agents

Platform Access Setup

| Platform | Device Type | Storage Required | Installation Time |

| MT5 Desktop | Windows/Mac | 1 GB | 5-10 minutes |

| Deriv GO | iOS/Android | 200 MB | 2-5 minutes |

| Deriv Trader | Web Browser | N/A | Immediate |

| DBot | Web Browser | N/A | Immediate |

Platform Configuration

Trading platform setup requires initial configuration. Chart preferences save user settings. Trading tools need parameter configuration. Automated features require permission settings. Mobile notifications need user authorization.

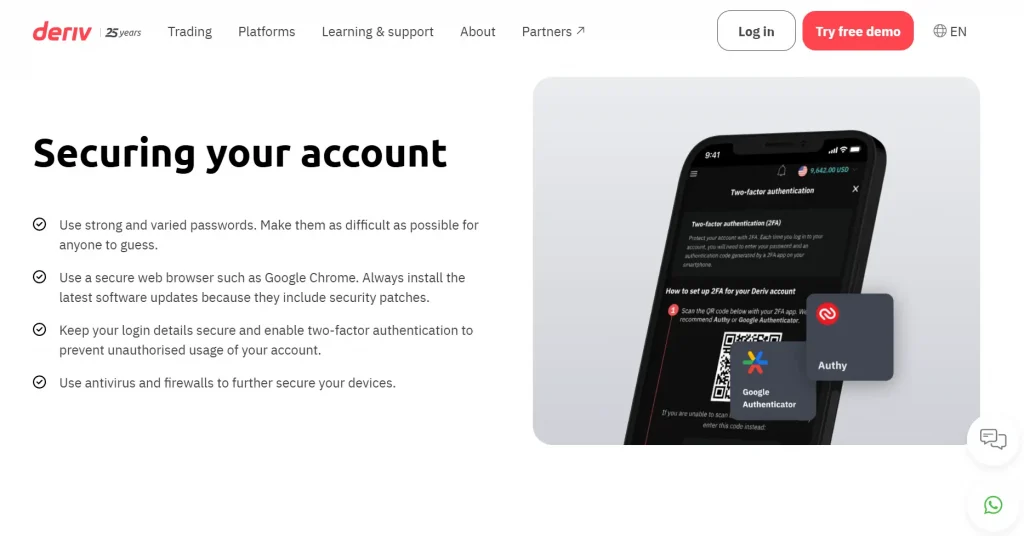

Security Setup Process

Security configuration establishes account protection measures. Two-factor authentication enables additional security. Password requirements maintain strength standards. Device recognition improves access security. Location tracking prevents unauthorized access.

Account Funding Process

Initial funding enables live trading activation. Minimum deposit requirements vary by method. Transaction processing follows security protocols. Currency conversion applies market rates. Funding confirmation arrives through notification.

FAQ

Standard account verification requires one to three business days after document submission.

Recent utility bills, bank statements, or government-issued documents within three months validity.

Each trading account maintains separate base currency selection during registration.